Retirement

It’s the age-old question – Do I have enough?

Retirement is the beginning of one of the most exciting and rewarding stages of life. Whether you have retired early, late or at an average age, your financial journey is far from over. Now is the time to make smart financial decisions and to take extra special care of the money you have accumulated. How you stay on track to meet your dreams and goals, will be determined by your personal circumstances and where you are now.

Our clients tell us they’re so busy, they don’t know how they found the time to go to work. We’re here to ensure that continues happening, giving you the confidence to enjoy your retirement knowing we are across the complexities that require attention over time.

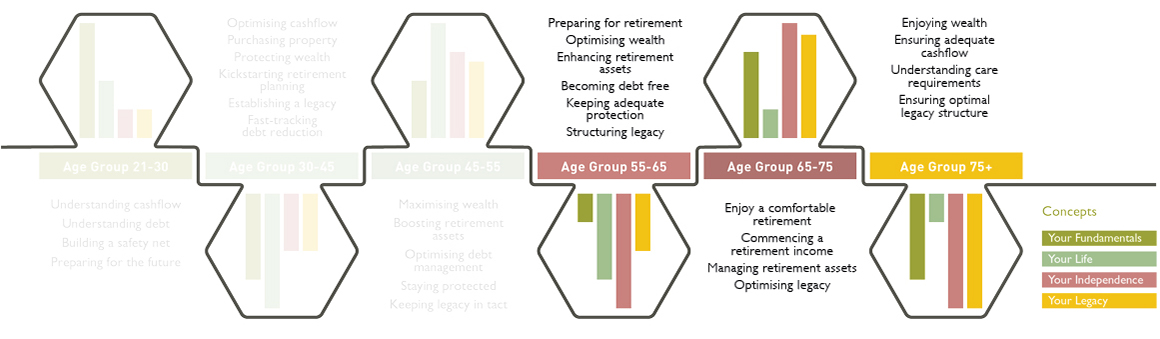

Where do you see yourself?

Our Team is here to guide you:

Retirement Related Articles

A 5 step plan to selecting your Home Care provider

Aged care services are many and varied, and Home Care is an integral service offering. It’s important because it can help you remain independent, in your own home, for as long as possible. Because everyone’s needs and circumstances are different, a range of Home Care services are available to you – the challenge is selecting […]

Federal Budget 2020: Economic recovery plan for Australia

As predicted, spending to stimulate the Australian economy was the focus of this year’s Federal Budget. The JobMaker Plan is the Government’s $74 billion response to support a stronger economic recovery and bring more Australians back to work. Tax cuts for individuals and business is also a major element of the recovery plan. Below we […]