Market Review – March 2021

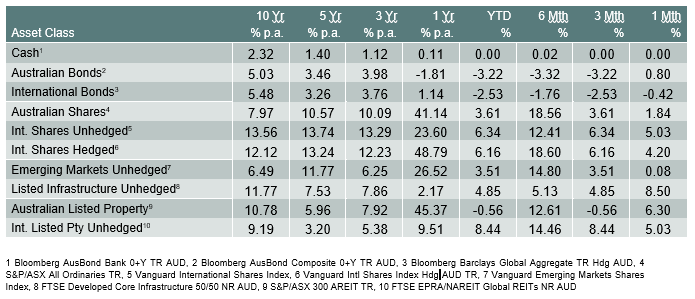

How the different asset classes have fared:

(As at 31 March 2021)

Domestic and International Fixed Income

After rising sharply in February, US Treasury yields continued to edge higher in March (prices fell), reflecting an improving outlook for the global economy due to the ongoing rollout of vaccines and the prospect of further significant fiscal stimulus in the US. At the end March, US President Biden announced a US$2.3 trillion “American Jobs Plan”. The plan focusses on infrastructure spending, spread over eight years, and is proposed to be funded by corporate tax increases spread over 15 years. This plan comes on top of a US$1.9 trillion relief package signed into law by President Biden in early March, and a US$900bn emergency relief package paid out in January. The Biden administration is expected to announce another package in coming weeks focused on childcare, healthcare and education, which will be funded by tax increases on wealthy individuals. As a result of the huge fiscal packages proposed by the Biden administration, the market is expecting the US economy to recover strongly. The markets’ belief in economic recovery and the inflation that may result have been contributing factors to rising bond yields. Central banks remain dovish, however, and have reiterated their commitment to keep easy policy in place for an extended period.

After increasingly sharply in February, Australian government bond yields declined slightly in March (prices rose). Bond prices were supported after the RBA reiterated its commitment to its 3-year bond yield target of 0.1% and reinforced its message that they do not expect the cash rate to increase until 2024 at the earliest. In its March meeting press release, the RBA also flagged that they are “prepared to do more” bond purchases if deemed necessary.

Australian Equities

The S&P/ASX All Ordinaries Index rose by 1.8% in March, underperforming a 4% gain (foreign currency hedged) in international share markets. The best performing sectors for the month were consumer discretionary and utilities. Strength in the Australian share market since the start of the year reflects a recovery in the domestic economy that continues to gather momentum. The labour market recovered further in February, with strong growth in employment and a decrease in the unemployment rate to 5.8%. The Australian housing market also continued to rise in March, increasing by 2.8% according to CoreLogic, which is the fastest monthly increase since the late 1980s. Strength in the housing market has been driven by strong demand from first home buyers.

International Equities

International share markets (foreign currency hedged) rallied by 4% in March. Share markets were buoyed by an improving outlook for the global economy due to the ongoing rollout of vaccines, together with the prospect of further significant fiscal stimulus in the US.

The S&P500 rose by 4.4%, driven by strong gains in value-oriented stocks which are expected to benefit from a strong global economic recovery. By contrast, high multiple and long duration growth stocks, such as US technology stocks, underperformed shorter duration and more cyclically levered-value stocks over the month.

European shares rallied in March, while emerging market shares underperformed due to weakness in Chinese equities. Chinese equities were reportedly weighed down by concerns around earnings and tighter liquidity conditions from the People’s Bank of China.

Australian Dollar

The Australian dollar decreased modestly in March alongside a decline in iron ore prices (albeit from very high levels) and a narrowing in the spread between Australian and US government bond yields.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.