Market Review – October 2021

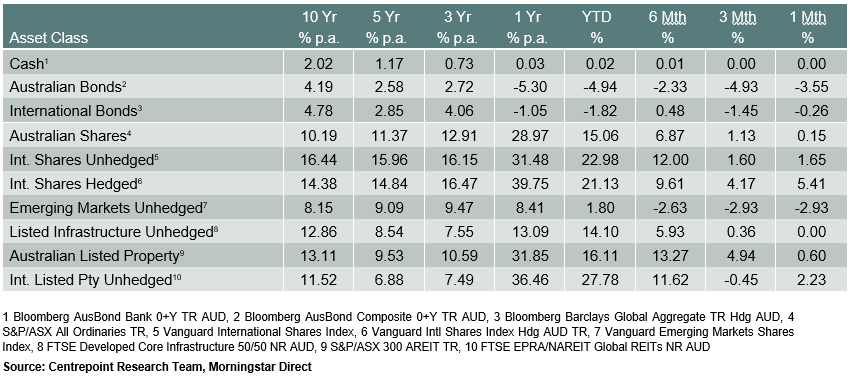

How the different asset classes have fared:

(As at 31 October 2021)

International Equities

International share markets (unhedged) rose 1.65% in October. Fully hedged international shares rose 5.41% on the month signaling a strengthening AUD across the month. Within the United States, the S&P 500 continues to make new all-time highs as markets in general have largely shrugged off the fears of inflation.

Australian Equities

The S&P/ASX All Ordinaries Index rose by 0.15% in October, rising not nearly as much as other markets such as the US. Australian equities traded largely sidewards since August 2021. This has been primarily driven by major materials companies getting impacted by the sharp fall in the iron ore spot price. Materials companies make up a significant percentage of the wider index. This is combined with various economic indicators such a rise in unemployment and a fall in consumer confidence which can be attributed to a slight rise in inflation expectations.

Domestic and International Fixed Income

Australian bonds had a significant fall in the final week of October (-3.55%). This was driven by an indication of policy change by the RBA as they stopped purchasing short-dated bonds which was part of their yield-curve control policy. Short-term yields rose sharply causing the Australian Bond Index to sell off. Sooner than expected rate rises could be what the RBA is attempting to set the stage for.

International bonds fell -0.26% as long dated government yields rose slightly. Inflation is now sitting at a 30 year high in the United States and looks to be moving upwards in many countries around the world. This is having an impact on bond yields and may cause central banks to start thinking about rising rates at a faster pace than previously anticipated.

Australian Dollar

The Australian dollar rose significantly in the month of October as it continues to move in a choppy trading pattern. Multiple factors such as rising inflation, central bank policy expectations, economic impacts of a slowing China and internal economic dynamics are all trying to be priced into the Australian Dollar causing a lack of clear trading direction at this point in time.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.